The Case for Business Valuation Software by David Fein

David Fein, CEO of ValuSource joined the Around the Valuation World team on January 23, 2023, to talk about business valuation software. David discusses what valuation software is and why it’s worth considering using to automate and standardize your valuation practice.

ValuSource has been at the forefront of developing business valuation software for almost 40 years. With the rapid evolution of technology, ValuSource’ s valuation software is more powerful, more transparent, and more customizable than ever before.

Automate and Standardize Valuation with Technology

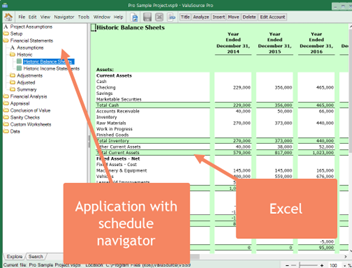

Since most valuators rely on proprietary spreadsheets and Word documents, they already have the Excel and Word skills they need to be able to use ValuSource’s software because our software is built on top of Microsoft Excel and Word. You get the best of both worlds, the complete customizability and flexibility of Excel and Word as well as a comprehensive valuation application that pulls everything together from data input, analysis, data through report writing.

The software is designed to automate and standardize the complex standards-based valuation process, not provide the valuation expertise to make all the decisions that a valuation requires. Valuation software does NOT replace the valuator, but it does make the valuator more efficient. Using software will substantially increase your efficiency and help you produce better valuations in less time. How can software help you to perform better valuations? Because, by automating routine tasks, you’ll have more time to spend on the most important aspects of the valuation where your expertise is really required.

“No one would ever question the value of valuator’s spreadsheets and the role they play. But what many valuators don’t realize is that when you create complicated Excel models,” says David. “You are really developing software with all the inherent software development issues including creating specifications, testing and quality assurance, maintenance, training, support and updates.”

ValuSource has been developing these tools for decades, with a team of valuation and software professionals and thousands of users over many years who help us assure the software is complete and does what it’s supposed to do.

How it works: Input, Analysis, Data & Reports

The software is designed around Microsoft Excel and Word and uses regular Excel spreadsheets and Word documents as it’s files. The software provides a comprehensive step-by-step framework to walk you through the entire valuation process.

ValuSource Pro / BVM Pro Application

“Since we build the software around Excel and it is based on the valuation body of knowledge and industry standards, the software is designed to take of care of the details and routine tasks,” says David. “You don’t have to build all the valuation models, but you’re still making all the decisions.”

Valuation theory is built into the software, meaning all the input, analysis and valuation methods are applied according to industry standards. The software simply helps to automate and standardize the entire process while providing the flexibility for you to customize things when you need to. The result is a robust valuation including the written report, all created in less time.

Even if you are a valuation expert, it’s very useful to have a step-by-step approach for performing a valuation. This provides a process and checklist driven approach that speeds things up, reduces mistakes, and makes sole practitioner, multi-person, and multi-location valuation teams more effective. If your realization rates are lower than you would like, the software will help. The software also integrates valuation data into the analysis and report, which is a time saver. The automatic report writer saves up to 50% of the time it takes to create a draft written valuation report.

“The report writer automates and standardizes the creation of the report and allows you to customize the report in Word,” says David. “We encourage you to take your reports and hook them up to our analysis (i.e., Excel file) or take a blended approach by customizing our templates to your firm’s language, style, and standards– you’ll see the benefits immediately. The reports maintain links back to your Excel file, so any changes in Excel get reflected in the Word report (i.e., all the numbers, tables, and charts), no more cutting and pasting between Excel and Word.”

Better Quality Control

The fact is that thousands of calculations exist in most valuation spreadsheets, and they are complicated. “Quality control in valuation is crucial, especially if there’s more than one valuator in the firm or there is more than one location. Without software, it’s challenging to manage and maintain those Excel files being used for valuation,” says David.

“It’s time for business valuators to look at how much time they are wasting doing things in Excel and Word that could and should be automated or streamlined and ask themselves if continuing to do everything manually is really worth it,” says David. “There are also people in the industry who have spent a lot of time automating their own Excel spreadsheets, but they can spend an incredible amount of time and energy doing it, which can be counterproductive when a professional strength solution already exists.”

A few years ago, Darrell Dorrell wrote a great article called Build or Buy about whether it’s time to consider using valuation software, I suggest you take a look here.

Whether you decide to use valuation software or not, take some time to review your process, your Excel and Word files and see if there is a way to improve, streamline or automate things to make your process better. And if you don’t know basic Excel macros, learn to use them!